Digital Banking Trends

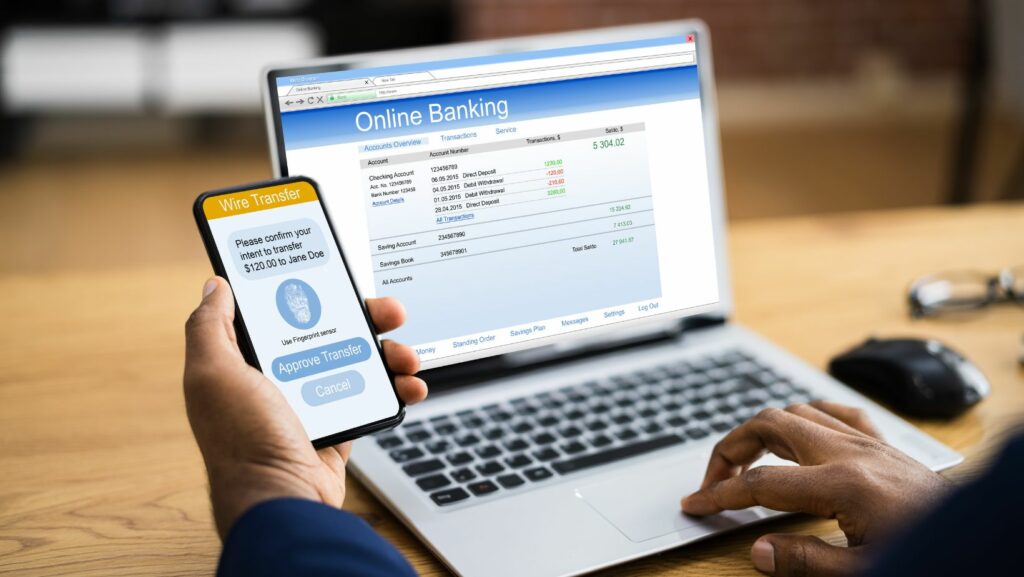

Mobile banking has seen exponential growth in recent years. According to a survey by Statista, in 2020, over 1.9 billion people used mobile banking apps. This surge is driven by the need for convenient, on-the-go financial management, which mobile platforms readily provide. Users can check balances, transfer money, and even apply for loans without visiting a physical branch.

Financial institutions have responded by enhancing their mobile app features. Banks like Chase and Bank of America offer advanced functionalities such as mobile check deposits, personal finance tools, and real-time alerts. These features improve customer experience and reduce the need for in-person interactions.

Security is a top priority in mobile banking. Banks employ multi-factor authentication (MFA), encryption, and biometric verification to protect users’ information. For instance, using fingerprint or facial recognition adds an extra layer of security, making transactions more secure.

Emerging technologies continue to influence mobile banking. Artificial intelligence (AI) and machine learning (ML) are integrated into apps for personalized financial advice and fraud detection. AI-driven chatbots handle routine inquiries, freeing up human resources for more complex issues.

The rise of mobile banking isn’t confined to developed markets; it also impacts developing regions. Many banks in these areas leverage mobile platforms to offer banking services to unbanked populations. Mobile money services in Africa, such as M-Pesa, illustrate this trend, providing people with access to essential financial services without needing a traditional bank account.

Increased adoption of mobile banking corresponds with changing consumer expectations. People’s preference for Digital Banking Trends solutions over traditional banking methods is clear. As technology evolves, mobile banking services are set to become even more integral to daily financial management.

AI and Machine Learning in Banking

AI and machine learning are transforming the banking sector by enhancing customer experiences and reinforcing security measures. AI and machine learning enable banks to offer personalized services tailored to individual customer needs. These technologies analyze data from users’ transaction histories, spending patterns, and financial behaviors.  For example, AI-driven algorithms suggest customized financial products like loans or credit cards based on a customer’s credit score and spending habits. Machine learning models predict customer needs, such as investment opportunities or savings goals, offering tailored advice through banking apps.

For example, AI-driven algorithms suggest customized financial products like loans or credit cards based on a customer’s credit score and spending habits. Machine learning models predict customer needs, such as investment opportunities or savings goals, offering tailored advice through banking apps.

Banks use AI and machine learning to strengthen fraud detection systems. These technologies identify suspicious activities in real-time, analyzing vast amounts of transaction data. For instance, machine learning algorithms detect unusual patterns, such as an unexpected purchase in a foreign country, and flag them for further investigation. According to a 2021 report by McKinsey, banks using AI for fraud detection reduce false positives by up to 50%, improving the accuracy of fraud prevention systems. By staying ahead of potential threats, banks protect customer assets and maintain trust.

Open Banking and APIs

Open banking and APIs are transforming how financial institutions interact with customers and share data. Open banking enhances customer experience by providing seamless access to multiple accounts through a single platform. APIs enable third-party developers to create innovative applications that integrate with bank systems, offering personalized financial management tools. Banks use APIs to provide real-time account information, allowing users to view balances, track spending, and manage finances efficiently. By collaborating with fintech companies, banks can offer advanced services like investment advice and budget planning, tailored to individual needs.

APIs streamline financial product integration, enabling banks to offer diverse services more effectively. By connecting different financial products through APIs, institutions create a unified ecosystem where customers access loans, insurance, and investment products from one interface. APIs facilitate the sharing of data between banks and third-party providers, ensuring that customers receive cohesive and coordinated services. This integration simplifies the user experience, reducing the need for multiple logins or platform switches. As a result, customers enjoy a more cohesive and user-friendly banking experience.

Digital banking is rapidly transforming the financial landscape, driven by advancements in technology and evolving consumer demands. The integration of AI, machine learning, and blockchain is enhancing security, personalizing services, and streamlining transactions. Mobile banking’s rise is making financial management more accessible, while open banking and APIs are fostering innovation and improving user experiences.